⛵ The $70B AI Crush

Good Morning, Early Adopters!

Empires that built the rules now bend to them, and platforms once fed by inspiration are running out of it.

FORECAST

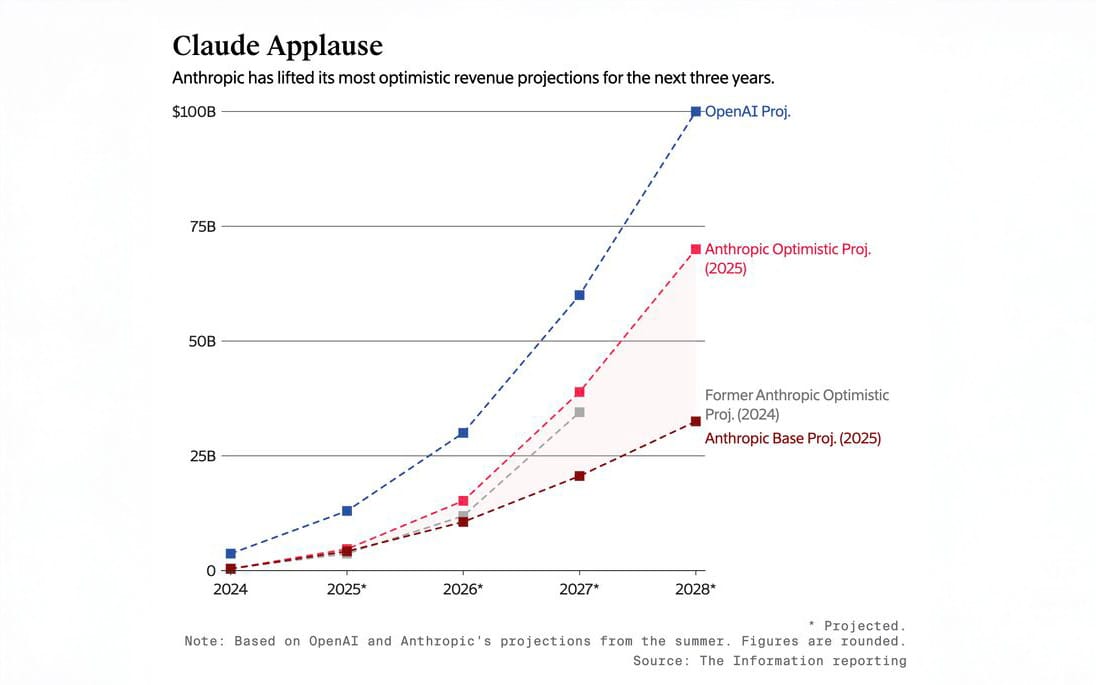

Anthropic Aims to Outcash OpenAI

👀 What’s the move: According to The Information, Anthropic has quietly rewritten the leaderboard of AI economics. The Claude maker now projects up to $70 billion in revenue and $17 billion in positive cash flow by 2028, buoyed by an enterprise-first strategy that already outpaces OpenAI’s API sales two-to-one. Its margins are swinging from –94 % to 77 %, and the company expects to hit positive cash flow as early as 2027, which is three years ahead of OpenAI.

💡 Why it’s not boring: If these numbers hold, Anthropic won’t just be the fastest-growing model shop; it’ll be the first major AI company to turn the GPU burn into net inflow. While OpenAI spends toward a platform empire (ads, devices, consumer apps), Anthropic is quietly building a high-margin software machine for the Fortune 500. Profitability, not virality, could become the next moat.

⛵ Key takeaway: OpenAI made AI a household name, but Anthropic might be the first one that makes it a sustainable business.

TOGETHER WITH BYTEPLUS

Seedance 1.0 Pro Fast — Ultra-Fast, Pro-Quality AI Video Generation

Introducing Seedance 1.0 Pro Fast, the latest breakthrough from BytePlus that pushes the frontier of AI-driven video creation. Built for creators and enterprises demanding both speed and cinematic quality, Seedance redefines efficiency — generating an 8-second 720p video in just 26 seconds, making it up to 4× faster than Veo3 Fast while maintaining professional-grade realism and style consistency.

Powered by advanced semantic understanding and motion simulation, Seedance analyzes prompts, reference images, and scene logic to interpret intent, infer motion, and complete coherent storylines. The result is a video that feels natural, expressive, and emotionally engaging — not just rendered, but directed.

Compared with Veo3 Fast, Seedance delivers smoother motion control, stronger prompt adherence, and more physical realism, especially in complex or high-action scenes. Its multi-shot storytelling engine plans zooms, transitions, and perspective shifts automatically, enabling creators to achieve cinematic rhythm and flow without manual edits.

Supporting flexible output from 2–12 seconds at 480p, 720p, or 1080p, Seedance gives you the freedom to create faster, better, and more affordably — breaking the old speed–quality–cost triangle and setting a new benchmark for AI video generation.

LAWSUIT

Google Bends the Knee to Epic, Cracks Open the Android Gate

👀 What’s the move: After five years of courtroom trench warfare, Google has agreed to overhaul its Android app store rules in a landmark settlement with Fortnite maker Epic Games. The deal allows third-party app stores easier entry onto Android devices, gives developers freedom to route payments through outside systems, and caps Google’s service fee at 9–20%. It’s a clear climb-down from the pre-settlement regime, where Google tightly controlled distribution and took up to a 30% cut on all transactions.

💡 Why it’s not boring: This isn’t just a legal truce; it’s a rewiring of Android’s global power structure. Before, Google’s “Play or nothing” policy locked developers into its ecosystem under the guise of security; now, with court-blessed openness, rival stores like Epic Games, Amazon, or even emerging AI-powered marketplaces can plug straight into the Android economy. It could ignite a new wave of distribution competition or fracture the Play Store’s billion-user network if others move fast enough.

⛵ Key takeaway: The age of Android gatekeeping is over; the open platform Google once promised has finally arrived, just not on its own terms.

ADS

Pinterest’s Pretty Pictures Stopped Printing Money

👀 What’s the move: Pinterest shares crashed 21% after releasing its latest earnings, erasing nearly $5 billion in market value as the company warned of weak ad spending and tariff headwinds. Despite rolling out AI-driven ad tools and e-commerce integrations this year, the platform’s core business is still flatlining while rivals like Meta, Google, and even Reddit are thriving on ad momentum.

💡 Why it’s not boring: This isn’t just another bad quarter; it’s a signal that Pinterest’s “visual discovery” niche may have lost its commercial gravity. Retail advertisers are fleeing to platforms with scale, AI targeting, and closed-loop commerce. Pinterest tried to reinvent itself as a shoppable search engine, but it’s increasingly looking like an algorithmic ghost town — too artsy to monetize, too small to matter.

⛵ Key takeaway: Pinterest built an inspiration machine, but in an AI ad war, inspiration doesn’t pay rent.

STARTUP SPOT

🎯 Armis

“See every asset — secure every risk.”

Enterprise cyber-exposure platform that uses AI-driven asset-intelligence to discover, monitor, and protect IT/OT/IoT/medical devices in real time. → Founded 2016 by co-founders Yevgeny Dibrov (CEO) & Nadir Izrael (CTO) with roots in Israeli Unit 8200. Recently raised $435M at a $6.1B valuation in a pre-IPO round.

📱 DualBird

“Hardware-accelerated data infra for the AI age.”

Accelerates big-data platforms like Spark & Iceberg by deploying a custom HW/SW stack in the cloud to deliver 10–100× higher throughput and 50–90% cost reduction.

→ Founded in 2022 (HQ in Westborough, MA with Israeli roots) and part of the Intel Ignite Spring ’22 cohort. Raised a seed round (~US$16–25M) to date and positioning itself as a deep-tech “data GPU” layer for enterprises.

💲 Fintary

“AI-powered financial ops for insurance.”

Platform automates and reconciles commissions, revenue and payouts for brokerages and carriers; tailors workflows and data ingestion for the insurance back-office.

→ Founded ~2021, based in San Francisco; led by founder & CEO Qiyun Cai (ex-VC, insurance industry operator). Backed by Harlem Capital in pre-seed (~US$2M) and featured on lists of fintechs to watch in 2025.

BAY AREA MEMOS

- Bitcoin dropped near $100K triggering $1.6B in long liquidations, though analysts say its long-term outlook remains intact.

- Chrysler is recalling over 320,000 Jeep plug-in hybrids for battery fire risks, advising owners to park outside and avoid charging.

- SoftBank and OpenAI have formed a 50-50 joint venture in Japan named SB OAI Japan to launch “Crystal Intelligence,” an enterprise AI solution.

- Cybersecurity startup Armis raised 435 million dollars at a 6.1 billion valuation after rejecting buyout offers and aims to go public around late 2026.

- The FDA approved Forzinity, the first Barth syndrome treatment, overruling reviewers’ concerns about efficacy due to urgent patient need.

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, boasting over 2 million readers from leading companies such as OpenAI, Google, Meta, and Microsoft. Our Newsletter Brands:

- AI: AI Secret

- Tech & Business:: Bay Area Letters

- Robotics: Robotics Herald

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.