⛵ Satellites Won’t Die

Good Morning, Early Adopters!

The skies are restless, but not fading.

SPACE

NASA Bets $30M on Startup to Keep $500M Telescope Alive

👀 What’s the move: NASA tapped Arizona startup Katalyst to rescue the Neil Gehrels Swift Observatory, a $500M space telescope drifting toward atmospheric death by 2026. Katalyst will send up its Link spacecraft, modified to latch onto an “unprepared” satellite — one with no docking ports, no propulsion, and no design for servicing — and push it into a safer orbit.

💡 Why it’s not boring: Katalyst isn’t just patching up a telescope, it’s pioneering a new category: low-cost, modular orbital mechanics-as-a-service. Traditional satellites cost hundreds of millions and were disposable once their orbits decayed. Katalyst’s robotic platform, built for high-volume production at “single-digit millions,” flips the economics. If it succeeds, the company won’t just save assets for NASA; it sets the playbook for insurers, satellite operators, and yes, the Pentagon, to treat orbit like a maintainable grid instead of a junkyard.

⛵ Key takeaway: If Katalyst pulls this off, every satellite contract will need a new clause — not about launch, but about life extension.

TOGETHER WITH NEBIUS

Switch to Nebius and get more – including up to 3 months off your contract

Bring your AI workloads over and we’ll cover the migration cost and give you up to 3 months for free. Nebius delivers supercomputer performance with hyperscaler flexibility, so you can build and scale AI models faster.

TALENT

YC Finally Buries the Dropout Cult

👀 What’s the move: Y Combinator just launched Early Decision, a track for students who want to lock in YC funding now but join after they graduate. It’s a direct counter to Thiel’s $100k dropout fellowship and the Big Tech internship pipeline; YC doesn’t want to lose deal flow just because a 21-year-old decides to finish their degree.

💡 Why it’s not boring: For years, YC quietly thrived on the dropout mythos, with Houston, Huffman, and the Collisons all cast as icons of leaving school to build. But that story doesn’t sell anymore. Today’s Silicon Valley kids don’t see quitting college as brave; they see it as burning optionality in a world of rising tuition, unstable markets, and safer detours through Google or OpenAI internships. Meanwhile, YC’s competitors are lowering the bar: Thiel hands out $100k for dropping out, Neo Scholars and Founders Inc fund students with little more than a pitch, and Big Tech pipelines offer job security before graduation. Early Decision is YC’s answer, a way to pre-empt rivals and secure young talent early.

⛵ Key takeaway: Entrepreneurship now looks more like a hedged bet than a free fall.

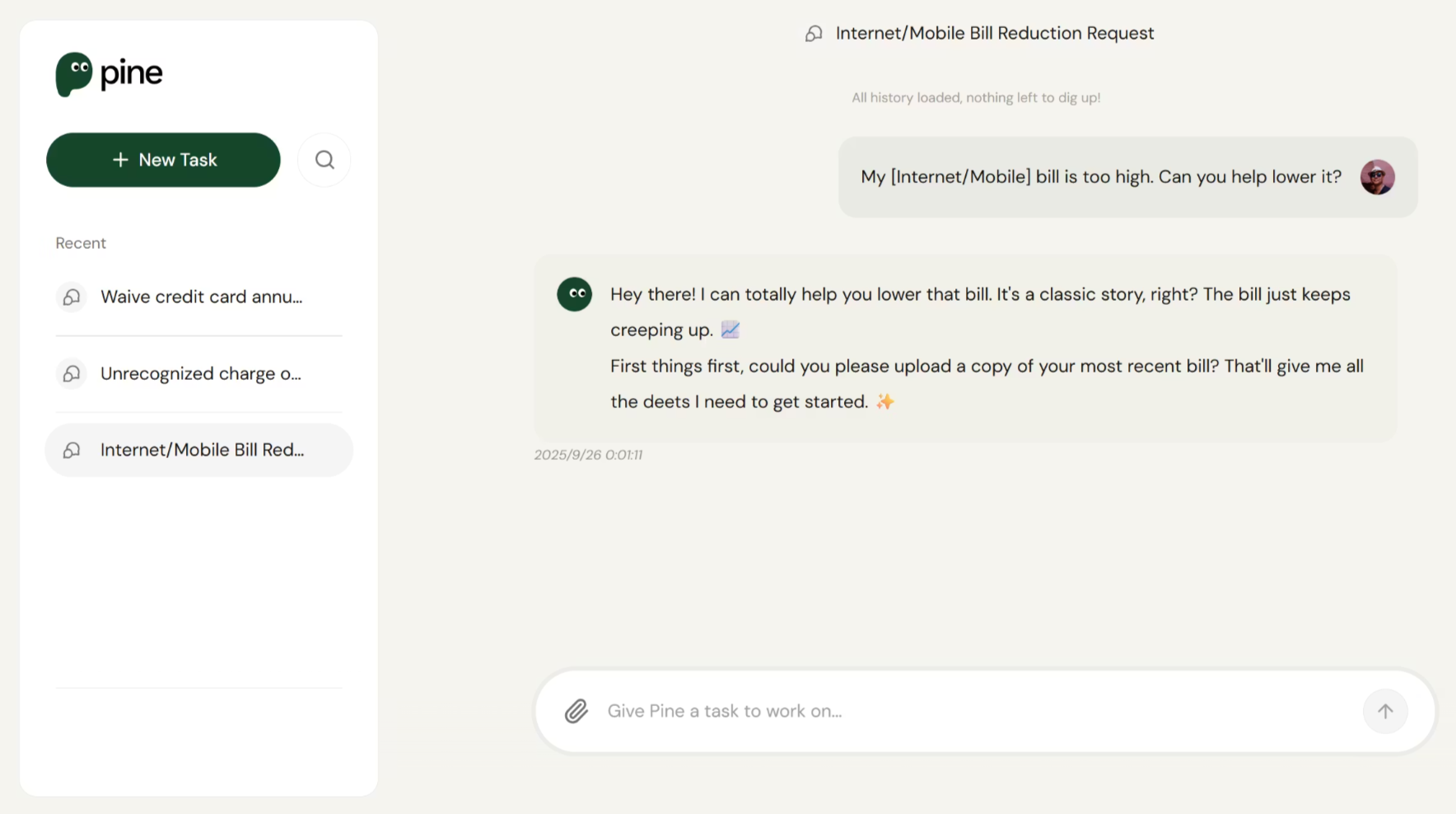

TOGETHER WITH PINE

The AI That Gets Your Money Back

From unfair fees to inflated bills, Pine AI Agent works behind the scenes to recover money that should be yours. Pine negotiates with providers and reduces costs on your behalf — it makes phone calls, negotiates bills, files complaints, cancels subscriptions, gets refunds, and more.

Stop leaving money on the table. Let Pine AI Agent fight for your wallet.

CRYPTO

Morgan Stanley Sneaks Into Crypto With Zerohash’s Plumbing

👀 What’s the move: Starting in 2026, Morgan Stanley’s E*Trade customers can buy bitcoin, ether, and solana not because the bank built a crypto desk, but because Zerohash provides the pipes. Zerohash handles custody, clearing, and compliance so Wall Street can dip a toe without touching the mess.

💡 Why it’s not boring: Zerohash’s “invisible infrastructure” lets incumbents offer crypto trading at scale without building bespoke systems or taking direct regulatory heat. For Morgan Stanley, this isn’t about chasing Robinhood’s token buffet; it’s about ensuring E*Trade doesn’t bleed customers in a $3.9T market. The strategy is clear: outsource the risk, keep the margin, and quietly own distribution.

⛵ Key takeaway: Wall Street’s crypto bet isn’t conviction; it’s convenience, with Zerohash selling shovels in the gold rush.

STARTUP SPOT

🧠 Zerohash

“API infra for crypto & tokens.”

Regulated rails for trading, tokenization, payments, on/off ramps for fintechs.

→ Founded by Edward Woodford; Series D-2 $104M (Sep 2025) led by Interactive Brokers + Morgan Stanley; ~$1B valuation, powering embedded crypto.

🪐 Katalyst

“Robotic servicing for satellites.”

Builds modular spacecraft to refuel, reposition, and extend satellite life in orbit.

→ Founded ~2020 in Arizona; acquired Atomos Space; won $30M NASA contract (Sep 2025) to rescue Swift observatory, showcasing space-docking tech.

🏢 Cohere

“Enterprise LLMs without bloat.”

Delivers secure, private LLMs for finance, healthcare, and government with SaaS APIs.

→ Founded 2019 by Aidan Gomez, Ivan Zhang, Nick Frosst; $500M raise (Aug 2025) at $6.8B; ~$100M ARR, 85% from private deployments.

BAY AREA MEMOS

- Filevine raised $400M to scale its AI-powered legal case management platform used by 100,000 professionals across 6,000 organizations.

- Zoox is seeking a federal exemption to move its steering wheel- and pedal-free robotaxis from testing into full commercial operation.

- Waymo has launched “Waymo for Business,” letting companies provide robotaxi rides for employees and clients as it enters the corporate travel market.

- Instagram has surpassed 3 billion monthly users and is doubling down on DMs, Reels, and algorithm updates to drive further growth.

- Cohere raised another $100M at a $7B valuation and partnered with AMD to push its enterprise-focused AI sovereignty strategy.

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, boasting over 1 million readers from leading companies such as OpenAI, Google, Meta, and Microsoft. Our Newsletter Brands:

- AI: AI Secret

- Tech: Bay Area Letters

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.