⛵ Ripple Targets SWIFT

Good Morning, Early Adopters!

From blockchain to payroll to housing, power is shifting beneath old systems.

FINTECH

Ripple Buys Its Way Into the Core of Corporate Finance

👀 What’s the move: Ripple just bought GTreasury, a long-standing corporate treasury management firm, for $1 billion. This is its third acquisition this year after Hidden Road (prime brokerage) and Rail (stablecoin platform). The play connects Ripple’s blockchain rails with GTreasury’s enterprise clients, letting corporates move, store, and earn yield on digital assets like stablecoins and tokenized deposits with 24/7 liquidity and instant cross-border settlement.

💡 Why it’s not boring: This isn’t about crypto, it’s about fighting SWIFT. Ripple’s stitching together the pipes of global money movement: custody (BBVA deal), yield (Franklin Templeton tie-up), and now corporate treasury infra. GTreasury gives Ripple what banks already have, which is compliance-grade trust and enterprise distribution, while building it on top of crypto-native infrastructure. If this works, Ripple stops being a blockchain company and starts being a settlement network for the fiat world.

⛵ Key takeaway: Ripple isn’t chasing tokens anymore; it’s rebuilding the banking stack, one acquisition at a time.

TOGETHER WITH OPTERY

The AI That Makes You Vanish

Optery is your AI-powered digital hitman for personal data. It scours the internet, finds where your private info is being sold, and deletes it—automatically. No forms. No emails. Just AI going full Liam Neeson on data brokers. Sleep better knowing your home address isn’t fueling someone’s creepy ad campaign.

PAYROLL

Deel Turns Controversy Into Capital With a $300M Raise

👀 What’s the move: Deel just pulled in $300 million at a $17.3 billion valuation, weeks after being tangled in a corporate espionage scandal with rival Rippling. The cash came from Ribbit, a16z, and Coatue, and it cements Deel as the most valuable payroll startup on the planet, now processing $22 billion in payroll a year with 37,000 clients.

💡 Why it’s not boring: This round marks a hard pivot in investor sentiment that HR tech is back from the dead. After a two-year drought, venture funding in HR software has nearly matched 2024’s total by September. Deel’s profitability and AI-automation push are rebranding HR not as a cost center, but as infrastructure for the distributed workforce era. The scandal barely dented confidence; investors are betting that whoever owns the payroll rails will own the next generation of global labor liquidity.

⛵ Key takeaway: Deel just proved trust issues don’t kill growth if you’re running everyone’s paycheck.

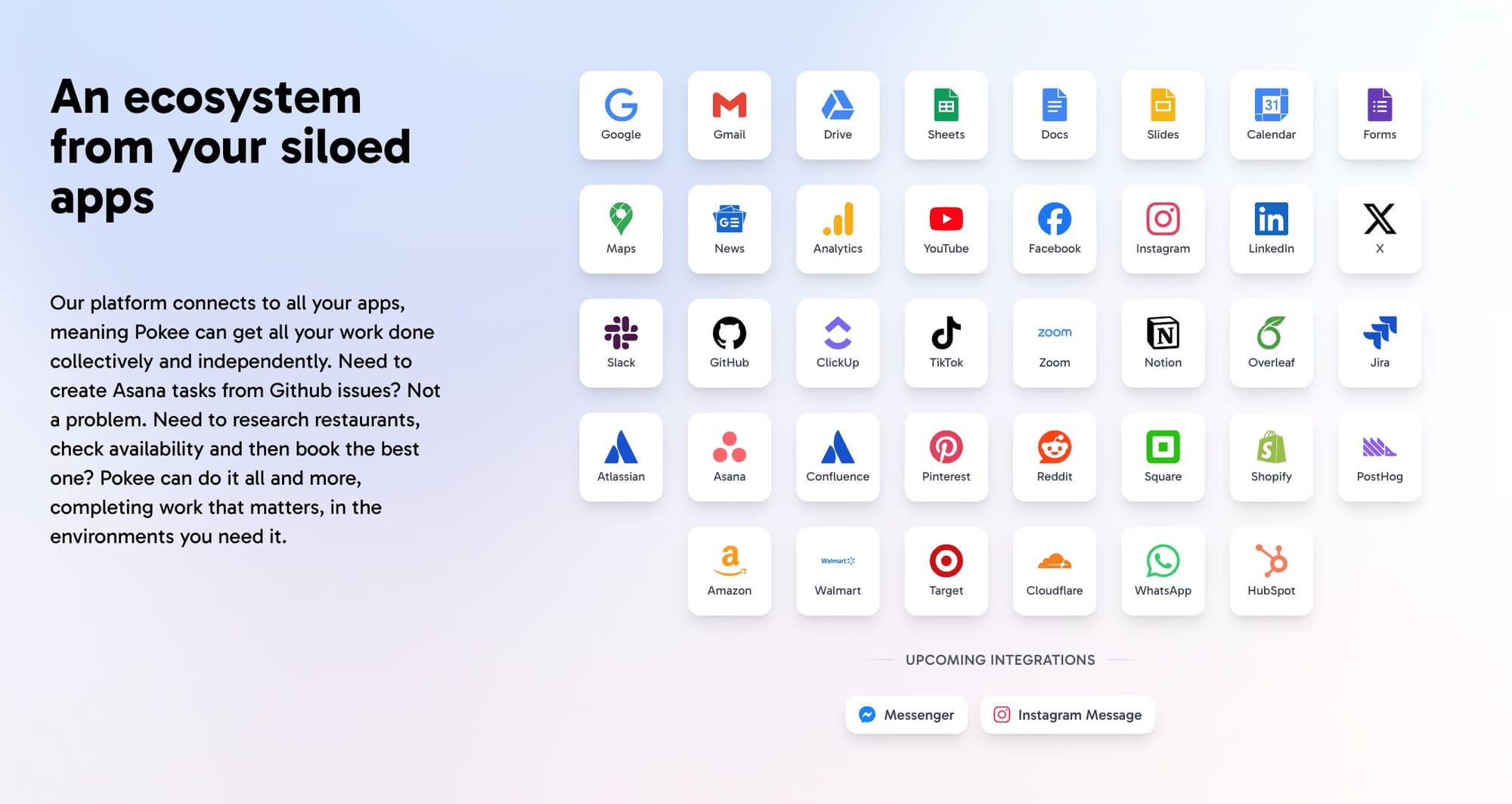

TOGETHER WITH POKEE

Automate Anything with a Prompt

Tired of switching between tools just to get one task done?

Pokee turns your text instructions into full automated workflows: from research and slides to LinkedIn posts and reports. No coding. No Zapier spaghetti. Just say what you need, and Pokee connects the dots across thousands of apps.

BILL

New York Just Outlawed Algorithmic Rent Collusion

👀 What’s the move: New York Governor Kathy Hochul signed the first statewide ban on AI rent-pricing tools, directly targeting software like RealPage that uses private data to “optimize” rents. The law classifies landlords who rely on these systems as engaging in price collusion, even if they claim ignorance, and follows years of investigations linking such algorithms to inflated housing costs.

💡 Why it’s not boring: This is not just a housing story but a signal that regulators are ready to treat algorithmic coordination as cartel behavior. Any SaaS vendor whose pricing logic influences multiple market participants, from adtech to logistics, is now under a new kind of scrutiny. AI’s promise of “efficiency” is being reframed as a potential engine for digital collusion.

⛵ Key takeaway: As markets lean on the same AI systems, regulators are no longer just watching deals; they are watching code.

STARTUP SPOT

🏦 GTreasury

“Intelligent liquidity for the enterprise.”

Cloud-native treasury and risk platform unifying cash, payments, and forecasting with AI-driven analytics and real-time visibility.

→ Founded 1986 by Orazio Manzi-Fe Pater; backed by Hg Capital; acquired by Ripple in 2025 for $1B to merge enterprise treasury management with blockchain settlement rails.

🛒 Zepto

“India’s 10-minute commerce engine.”

Runs a nationwide network of dark stores delivering groceries and essentials in minutes, redefining urban retail logistics.

→ Founded 2021 by Stanford dropouts Aadit Palicha & Kaivalya Vohra; raised $450M (2025) at $7B valuation; prepping IPO as India’s fastest-growing quick-commerce brand.

⚙️ Encube

“AI co-pilot for hardware design.”

Cloud platform that helps engineers detect manufacturability issues, simulate production trade-offs, and collaborate in real time.

→ Founded 2021 in Stockholm by Hugo Nordell & Johnny Bigert; raised €19M (2025) led by Kinnevik and Promus Ventures; used by Volvo, Scania, and Beyond Gravity to cut design cycles by 50%.

BAY AREA MEMOS

- Indian quick-commerce startup Zepto raised $450M led by CalPERS at a $7B valuation and plans to go public next year.

- Swedish startup Encube raised $23M for an AI platform that streamlines hardware design and cuts manufacturing costs.

- Amazon revealed plans for a small modular nuclear reactor project with up to 12 units in Washington to supply carbon-free power by the early 2030s.

- OpenAI and partners start building the 1GW Stargate UAE datacenter, with the first 200MW phase already under construction for 2026 delivery.

- Uber is turning its app into an AI training platform, letting drivers earn extra income by completing microtasks to help train AI models.

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, boasting over 1 million readers from leading companies such as OpenAI, Google, Meta, and Microsoft. Our Newsletter Brands:

- AI: AI Secret

- Tech: Bay Area Letters

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.