⛵ OpenAI–AMD Alliance

Good Morning, Early Adopters!

Progress always cuts both ways, as silicon grows smarter, institutions stumble, and the future keeps choosing new winners.

AI

The OpenAI–AMD Alliance Nobody Expected

👀 What’s the move: OpenAI has entered a multi-year agreement with AMD to secure hundreds of thousands of advanced AI chips, along with the right to acquire up to ten percent of AMD for one cent per share. The deal could generate more than one hundred billion dollars in revenue for AMD over four years, pushing its stock up thirty-four percent in a single day and adding eighty billion dollars in market value. For OpenAI, it offers both guaranteed compute and a new form of balance-sheet storytelling at a moment when its $500 billion valuation leaves little headroom in private markets.

💡 Why it’s not boring: OpenAI’s biggest bottleneck is no longer technology, it is structure. The company’s hybrid governance model that split between a nonprofit board and a capped for-profit entity makes a public listing nearly impossible in the short term and keeps it tethered to private equity rounds. But at its current valuation, even deep-pocketed investors are running out of room to justify another markup. This deal with AMD quietly rewrites that constraint. By embedding financial upside inside its hardware supply chain, OpenAI creates a new asset story that doesn’t require board approval or an IPO. The equity warrant functions as both an insurance policy against GPU scarcity and a backdoor form of capital appreciation. For AMD, it turns a customer into a co-strategist, and a rival to Nvidia’s dominance.

⛵ Key takeaway: OpenAI can’t fix its governance fast enough to go public, so it found another way to grow value — by investing in the chips that power its own future.

TOGETHER WITH CLOUDTALK

The Future of Customer Communication

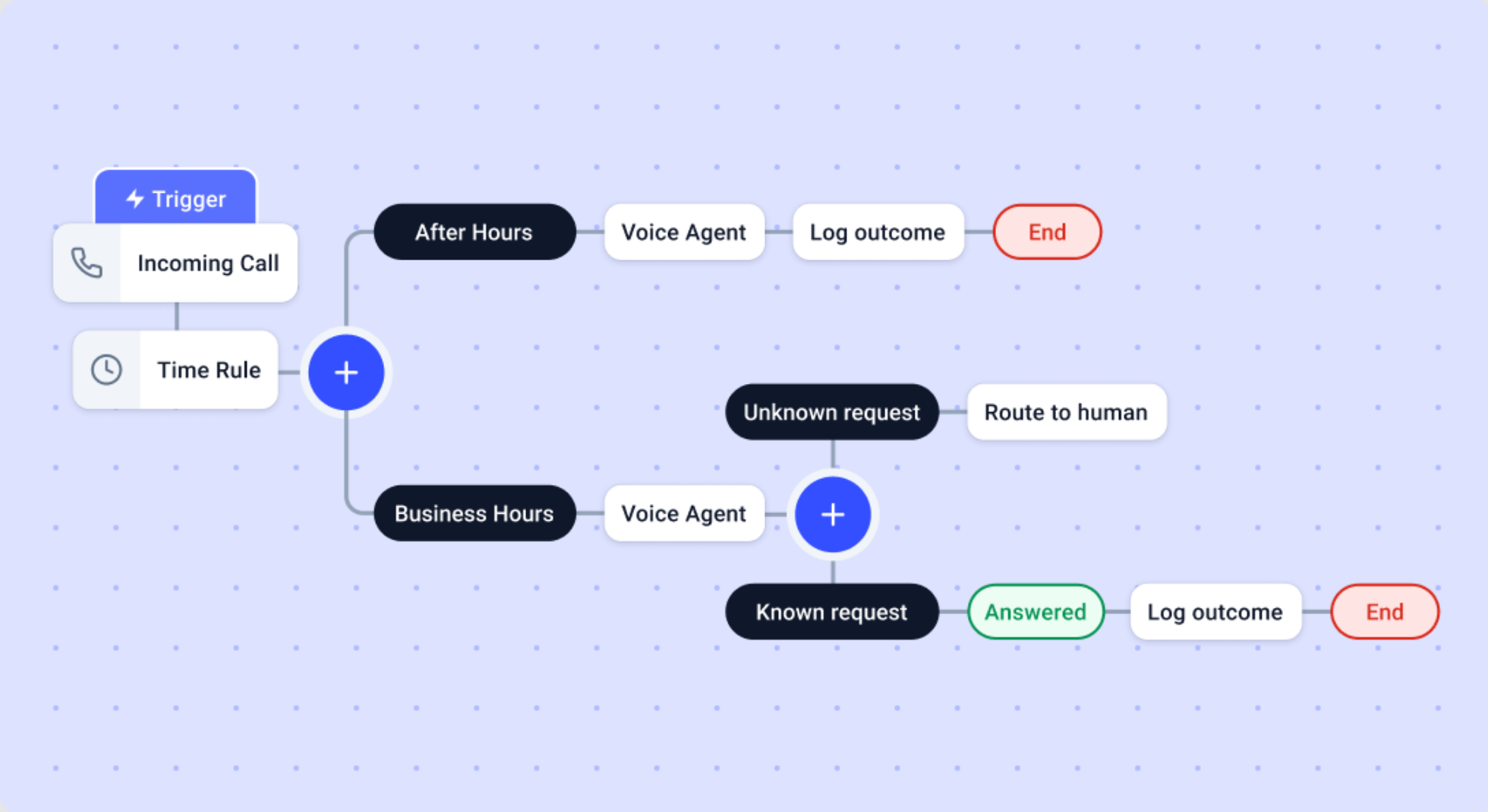

CloudTalk isn’t just another cloud call center—it’s where AI voice agents take the lead in transforming how businesses talk to customers. The AI voice agents handle repetitive inquiries, route calls intelligently, and provide instant answers—reducing wait times and boosting customer satisfaction.

For AI-driven companies, CloudTalk’s AI voice agents act as a growth multiplier:

- Automate first-line support and free up human agents.

- Personalize conversations with data-driven intelligence.

- Turn every call into structured insights for product and user research.

👉 In short: CloudTalk = global telephony + AI voice agents + seamless CRM workflows — a communication engine ready for the AI era.

LAWSUIT

Google’s 5-Year War with Epic Finally Breaks the Play Store

👀 What’s the move: The U.S. Supreme Court has refused to bail Google out of its years-long legal fight with Epic Games, forcing the company to open Android’s gates by October 22, 2025. After half a decade of courtroom battles that began with Epic’s 2020 lawsuit, Google must now let developers bypass its billing system, link to external downloads, and even host rival app stores inside Google Play.

💡 Why it’s not boring: This is not just a legal loss. It marks the first real crack in the mobile-platform duopoly. For years, Google and Apple have operated toll roads on digital commerce, taking 15 to 30 percent of every in-app purchase. Now a single court order is rewriting that model. If developers begin routing payments directly, billions in platform fees and Google’s control over distribution could disappear almost overnight.

⛵ Key takeaway: After five years of fighting Epic, Google may not have lost only a lawsuit. It may have lost the Play Store’s entire business model.

STRIKE

31,000 Nurses to Walk Out, Kaiser Faces Its Own Diagnosis

👀 What’s the move: Over 31,000 nurses and hospital staff at Kaiser Permanente will strike on October 14, following six months of stalled contract talks. The union, representing California and Hawaii healthcare workers, is demanding higher pay, stronger benefits, and more staffing to counter burnout and shortages. It’s the largest healthcare labor action in Kaiser’s history, affecting two dozen hospitals and clinics.

💡 Why it’s not boring: Kaiser isn’t just a hospital network; it is a $100B+ healthcare empire serving one in four Californians. A strike of this scale doesn’t just hit patient care; it hits the model of managed care itself. If the country’s most integrated health system can’t retain its caregivers, the domino effect could reshape labor expectations across U.S. healthcare and force private providers to rethink automation, scheduling, and even AI-driven staffing optimization.

⛵ Key takeaway: The frontline revolt has arrived at the heart of America’s healthcare system, and Kaiser now stands as the case study for whether hospitals are powered by empathy or algorithms.

STARTUP SPOT

🧠 Filigran

“AI threat intel made collaborative.”

Open-source cybersecurity suite turning threat data into shared defense systems through AI-driven intelligence (OpenCTI) and attack simulation (OpenBAS).

→ Founded 2022 by ex-CERT-EU director Samuel Hassine; backed by Insight Partners, Accel & Moonfire. Raised $58M (2025) to expand globally; clients include FBI & Airbus; part of French Tech Next40.

🩺 Heidi Health

“Your AI clinic co-pilot.”

Ambient AI that listens to consultations, writes notes, and syncs records—turning doctors’ talk into structured data in real time.

→ Founded by Dr. Thomas Kelly (ex-surgeon) with Waleed Mussa & Yu Liu; raised $16.6M Series A (2025); powering 1M+ consults per week across Australia, UK & US; rebranded from Oscer.

⚙️ Rebellions

“South Korea’s answer to Nvidia.”

Builds AI inference chips and servers optimized for low-power, high-throughput workloads—its ‘Rebel’ silicon rivals H100 efficiency at a fraction of the cost.

→ Founded 2020 by ex-Morgan Stanley quant Sung-hyun Park; partnered with Samsung for fabrication; raised $250M Series C (2025) from Arm & Samsung Ventures, valuing it at $1.4B.

BAY AREA MEMOS

- OpenAI reversed Sora 2’s policy after backlash over using Japanese anime IP without permission.

- Crunchbase data shows Q3 2025 venture funding surged 38% to $97B, driven by giant AI rounds like Anthropic’s $13B raise.

- Elon Musk’s xAI is spending $18B on Nvidia chips and a new power-fed data center to rival OpenAI.

- French cybersecurity startup Filigran raised $58 million to expand its AI-driven threat management platform and accelerate global growth.

- Microsoft bought 100 MW of solar power in Japan to support its expanding data center operations.

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, boasting over 1 million readers from leading companies such as OpenAI, Google, Meta, and Microsoft. Our Newsletter Brands:

- AI: AI Secret

- Tech: Bay Area Letters

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.