⛵ Nvidia Hits $5 Trillion

Good Morning, Early Adopters!

Fresh off Nvidia’s historic climb to a $5 trillion valuation, the AI world feels split between two futures.

MILESTONE

Nvidia Just Became the Market, Now Worth $5 Trillion

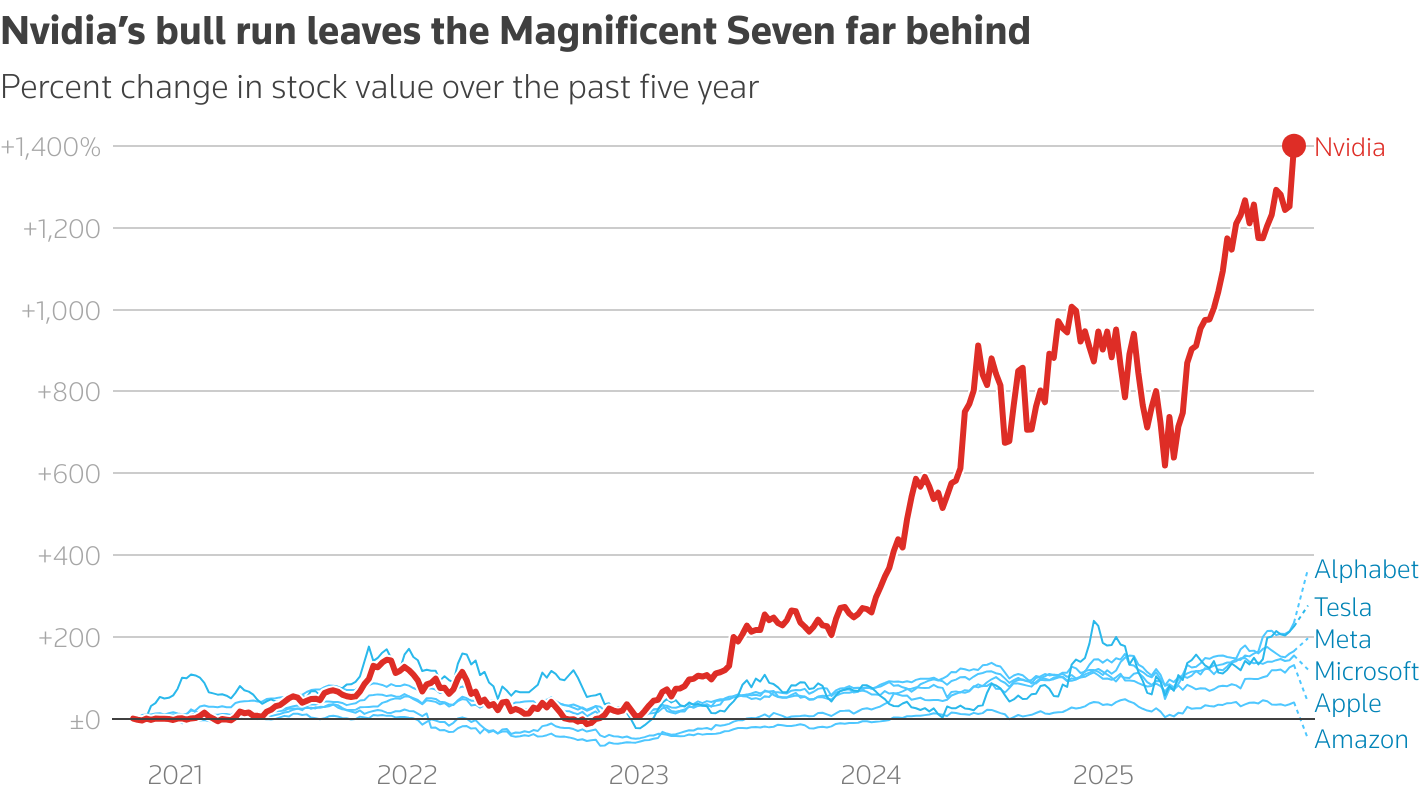

👀 What’s the move: Right after its Washington GTC showcase, Nvidia surged past the $5 trillion mark, only three months after it surpassed $4 trillion, becoming the first company in history to reach that valuation. The rally came after CEO Jensen Huang announced $500 billion in AI chip orders and a plan to build seven supercomputers for the U.S. government, solidifying Nvidia’s position as both the supplier and the architect of the AI economy.

💡 Why it’s not boring: This is not simply a stock milestone but a shift in global power. Nvidia’s Blackwell chips now sit at the intersection of politics, defense, and compute infrastructure. While Trump prepares to discuss those same chips with China, Nvidia has effectively turned its hardware into a tool of diplomacy. Every data center, language model, and military project now runs through Jensen Huang’s supply chain. The world’s most valuable company is no longer just a platform; it has become the physical foundation of the AI era.

⛵ Key takeaway: AI is not eating the world yet, because Nvidia already did.

TOGETHER WITH IMMERSED

This Pre-IPO Stock Is Up 4,000% Already

How do you follow 4,000% valuation growth? Keep pushing. That’s what Immersed did, reserving the Nasdaq ticker $IMRS. But investors are buying pre-IPO shares now.

1.4M people use their breakthrough productivity app, including Fortune 500 teams.

Google and Samsung partnered with them. Executives and founders from Intel, Facebook, and Reddit invested. You can too. But hurry.

This is a paid advertisement for Immersed’s Regulation CF offering. Please read the offering circular at invest.immersed.com.

RACE

Google Prints $100B While Meta Burns Cash

📌 What’s happening: Alphabet just closed its first $100 billion quarter powered by a unified AI stack that stretches from Gemini models to quantum chips. Every division, from Search to Cloud to Waymo, posted double-digit growth. Across the valley, Meta’s Q3 looked strong on paper with $51.2 billion in revenue, but an $18 billion tax charge and ballooning expenses turned it into a cautionary tale. Meta’s costs grew 32 percent, its net income collapsed 83 percent, and Reality Labs keeps bleeding billions.

💡 Why it’s not boring: Google has found religion in focus: one AI architecture, one execution rhythm, and one message. Meta, by contrast, is still swinging between “AI superintelligence,” “AI glasses,” and “metaverse aftershocks.” Pichai’s engineers ship coherent infrastructure; Zuckerberg’s teams wrestle over org charts and cloud contracts. The market sees it too — Google’s capex is strategic, Meta’s is reactionary. Investors know who’s scaling AI and who’s subsidizing confusion.

⛵ Key takeaway: AI is exposing management more than technology. Focus compounds, chaos compounds faster.

CHIPS

Washington Blocks ASML, While Silicon Valley Builds Its Replacement

👀 What’s the move: Substrate has raised $100 million from Founders Fund, General Catalyst, and In-Q-Tel to develop a new X-ray lithography system that could rival Dutch company ASML, the world’s only maker of extreme ultraviolet (EUV) machines. The irony is sharp: while Washington leans on the Netherlands to ban ASML’s exports to China in the name of “national security,” it quietly funds a homegrown startup through In-Q-Tel, the CIA’s own venture arm, to dismantle that same Dutch monopoly.

💡 Why it’s not boring: ASML’s $400 million EUV machines power the global chip supply chain, from TSMC’s two-nanometer fabs to Nvidia’s GPUs. The U.S. government tells allies to restrict access, yet its investors are betting on Substrate to build a domestic alternative that bypasses ASML entirely. The message is clear: the rules are for others, but the frontier belongs to Silicon Valley. If Substrate’s X-ray process works, America will have turned its export ban into an industrial shortcut.

⛵ Key takeaway: Publicly, Washington defends ASML’s monopoly. Privately, it’s funding the revolution to destroy it.

STARTUP SPOT

🧠 Reflectiz

“See every hidden script on your site.”

Monitors third-party web assets and scripts to detect supply-chain risks, data leaks, and skimming—without any agent or code change.

→ Founded 2016 in Tel Aviv by cybersecurity veterans Idan Cohen & Ysrael Gurt; raised $5 M Series A; integrated with Datadog in 2025; trusted by major banks and e-commerce brands.

💰 Zero Hash

“The API layer for crypto finance.”

Provides embedded infrastructure for trading, custody, settlement, and tokenization—letting fintechs add crypto and stablecoin rails in weeks.

→ Founded 2017 in Chicago; backed by Bain Capital Ventures, Point72 & NYCA; powers $2 B+ tokenized fund flows; reportedly in $1.5–2 B acquisition talks with Mastercard (2025).

🎥 Synthesia

“AI video without cameras.”

Lets teams generate studio-quality videos from text using lifelike avatars and voices in 120+ languages.

→ Founded 2017 in London by researchers from UCL, Stanford & TUM; used by 60% of Fortune 100; raised $180 M Series D at $2.1 B valuation (2025).

BAY AREA MEMOS

- According to Reuters, OpenAI is preparing for an IPO as early as 2026, aiming for a valuation of up to one trillion dollars.

- AWS has opened its $11 billion Project Rainier data center campus in Indiana to power Anthropic’s AI training and inference workloads.

- Reflectiz raised $22 million to enhance AI-driven protection against third-party and open-source website risks.

- Google is partnering with NextEra to restart an Iowa nuclear plant to power its data centers with zero-carbon energy.

- Mastercard is reportedly in talks to acquire stablecoin infrastructure firm Zero Hash for up to $2 billion.

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, boasting over 2 million readers from leading companies such as OpenAI, Google, Meta, and Microsoft. Our Newsletter Brands:

- AI: AI Secret

- Tech & Business:: Bay Area Letters

- Robotics: Robotics Herald

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.