⛵ Lunar Race

Good Morning, Early Adopters!

In a world where technological shifts collide with political maneuvers, the race for dominance no longer plays out on a single stage.

SPACE

Space Is No Longer Neutral—It’s a Hostile Asset Class

👀 What’s the move: Russia’s satellite hijack and whispers of space-based nukes expose what defense insiders already know: orbit is the next oil field. The moon’s helium-3, asteroid mining, and GPS dominance aren’t just science fiction—they’re trillion-dollar chokepoints. Corporates and states are suddenly in the same queue: guarding satellites is as urgent as guarding oil tankers.

💡 Why it’s not boring: The business world just got a new risk register. Every insurer, bank, and logistics firm is now exposed to orbital fragility. Lose satellites and you don’t just drop Netflix streams—you freeze shipping, payments, defense logistics. Meanwhile, whoever claims lunar energy gets to write the 21st-century energy rules. This isn’t defense theater; it’s a new commodity war in orbit.

⛵ Key takeaway: Space isn’t an exploration story anymore—it’s the next balance sheet risk and the last monopoly frontier.

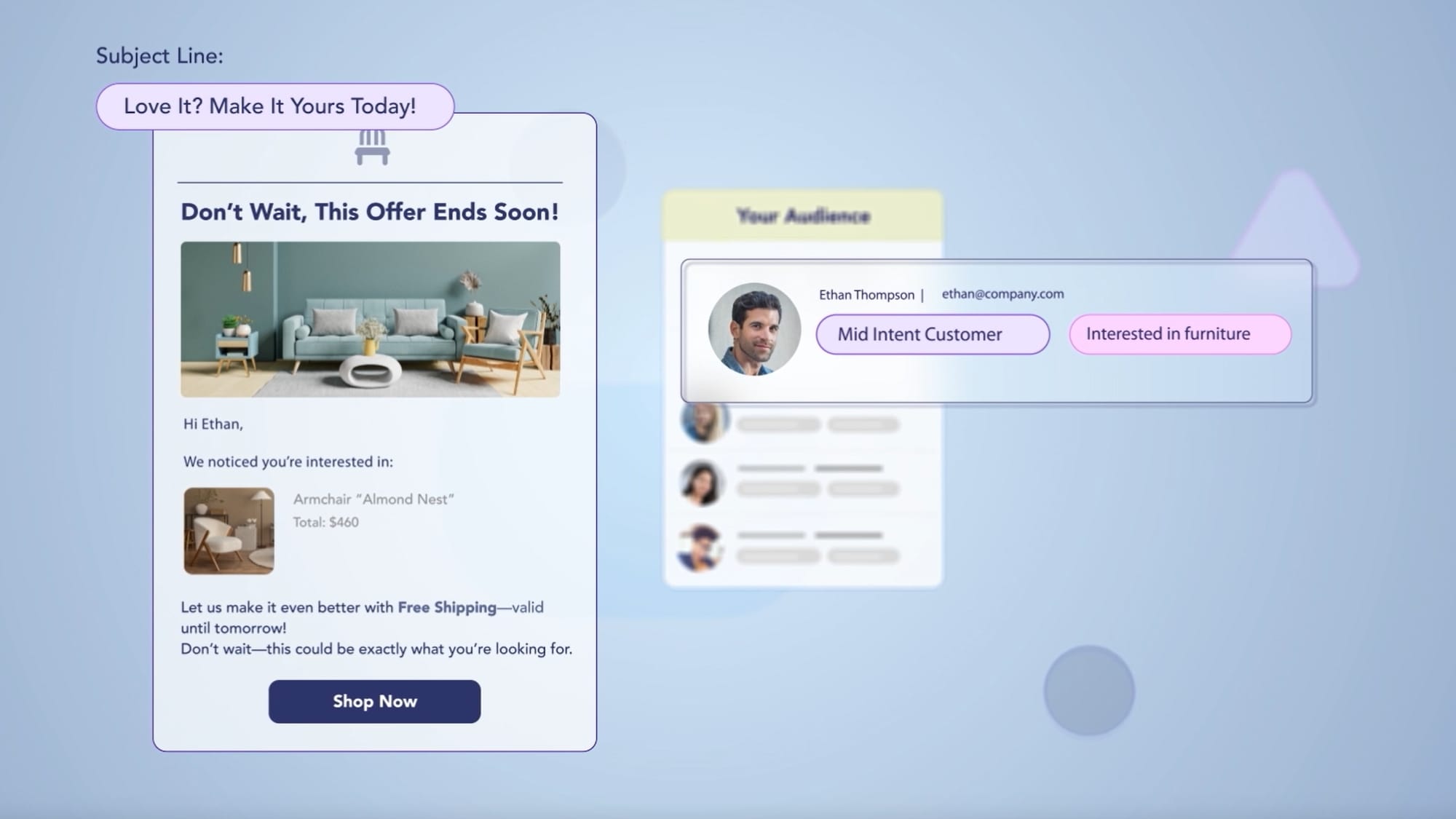

TOGETHER WITH MOOSEND

Your AI Marketing Sidekick

Moosend’s AI supercharges email marketing with smart, time-saving features:

- Generative AI Writer: Create subject lines, email copy, landing page content—or optimize tone—just by typing prompts.

- Audience Discovery: AI analyzes behavior to find high-potential segments and deliver content predictive of user intent.

- AI-Powered Product Recommendations: Dynamically suggest products based on behavior and purchase history for personalized campaigns.

Combined, Moosend’s AI tools boost open rates, conversion, and engagement by automating personalization at scale.

AI

Foxconn Shifts From Apple Factory to AI Giant

👀 What’s the move: For the first time, Foxconn’s revenue from AI servers and cloud gear just eclipsed iPhones. Consumer electronics slid to 35% of sales in Q2 2025, down from 54% in 2021, while AI servers — mostly for Nvidia — surged from less than 3o% to 41%. After years of hedging against iPhone stagnation, Foxconn has quietly become the world’s largest AI server maker with ~40% market share.

💡 Why it’s not boring: This isn’t just Foxconn’s pivot — it’s Taiwan’s. Quanta, Wistron, and the whole island’s ODM army are ditching gadgets for racks of GPUs, with Taiwan now building 90% of the world’s AI servers. The “iPhone city” is being rebuilt as an AI server nation.

⛵ Key takeaway: Apple made Foxconn rich; Nvidia will make it matter.

CHIPS

Trump Hijacks the Free Market

👀 What’s the move: The White House is reportedly pushing to convert Intel’s CHIPS Act grants into a 10% ownership stake. That means Washington wouldn’t just subsidize fabs—it would sit on the cap table. Intel gets faster access to cash, but not necessarily more of it.

💡 Why it’s not boring: This isn’t industrial policy—it’s state capitalism. Trump is turning “free market” subsidies into equity grabs, blurring the line between government backstop and government shareholder. If the logic holds, any chipmaker that takes federal aid could end up with Uncle Sam as a co-owner. That’s less about competition, more about control.

⛵ Key takeaway: When the state writes checks and keeps stock, the free market stops being free—it’s just a different monopoly.

STARTUP SPOT

🧾 Figure Technology

“Blockchain lending at scale.”

Originates & securitizes HELOCs, mortgages, crypto-backed loans—on Provenance blockchain for speed + liquidity

→ Founded 2018 by SoFi’s Mike Cagney & June Ou; July ’25 merged with Figure Markets to unify lending + digital assets; preparing Nasdaq IPO (ticker FIGR). H1 ’25 revenue $191M (+22% YoY), profit $29M vs. loss prior year; $16B+ loans originated; IPO underwritten by Goldman Sachs, Jefferies, BofA.

🧠 Regrello

“Agentic AI for factories.”

AI OS automating supply chain, engineering & quality workflows—replacing email + legacy ERPs with agentic, HITL flows

→ Founded 2020 by Aman Naimat (ex-White House COVID Task Force); backed by a16z, Tiger Global, Dell, Mubadala; trusted by global manufacturers; acquired by Salesforce in 2025 to power Agentforce + Slack.

🛡️ IVIX

“AI against shadow economies.”

OSINT + graph-AI to uncover shell firms, laundering & tax evasion for gov/regulators

→ Founded 2020 by Mattan Fattal & Doron Passov; Aug ’25 raised $60M Series B (total $85M) led by O.G. Venture Partners; used by U.S., EU, Asia agencies; >$1B illicit assets uncovered.

BAY AREA MEMOS

- The financial crime AI detection platform IVIX has raised $60 million in a Series B funding round to expand its market presence.

- The Texas attorney general is investigating Meta and Character.AI over concerns their chatbots are misleading young people seeking mental health support.

- Amid a wave of crypto IPOs, Figure Technology has filed to list on Nasdaq after reporting a $29 million profit for the first half of the year.

- After its London IPO plans stalled, Shein is now reportedly weighing a move back to China to facilitate a Hong Kong listing.

- Salesforce is acquiring Regrello to enhance its agentic process automation capabilities within Agentforce and Slack.

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, boasting over 1 million readers from leading companies such as OpenAI, Google, Meta, and Microsoft. Our Newsletter Brands:

- AI: AI Secret

- Tech: Bay Area Letters

- Futuristic: Posthuman

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.