⛵ Kill Switch

Good Morning, Early Adopters!

Boardrooms are rewriting survival scripts, from Tokyo to Berlin. The common thread? Power players pulling hard resets before the system shuts them down.

CHIPS

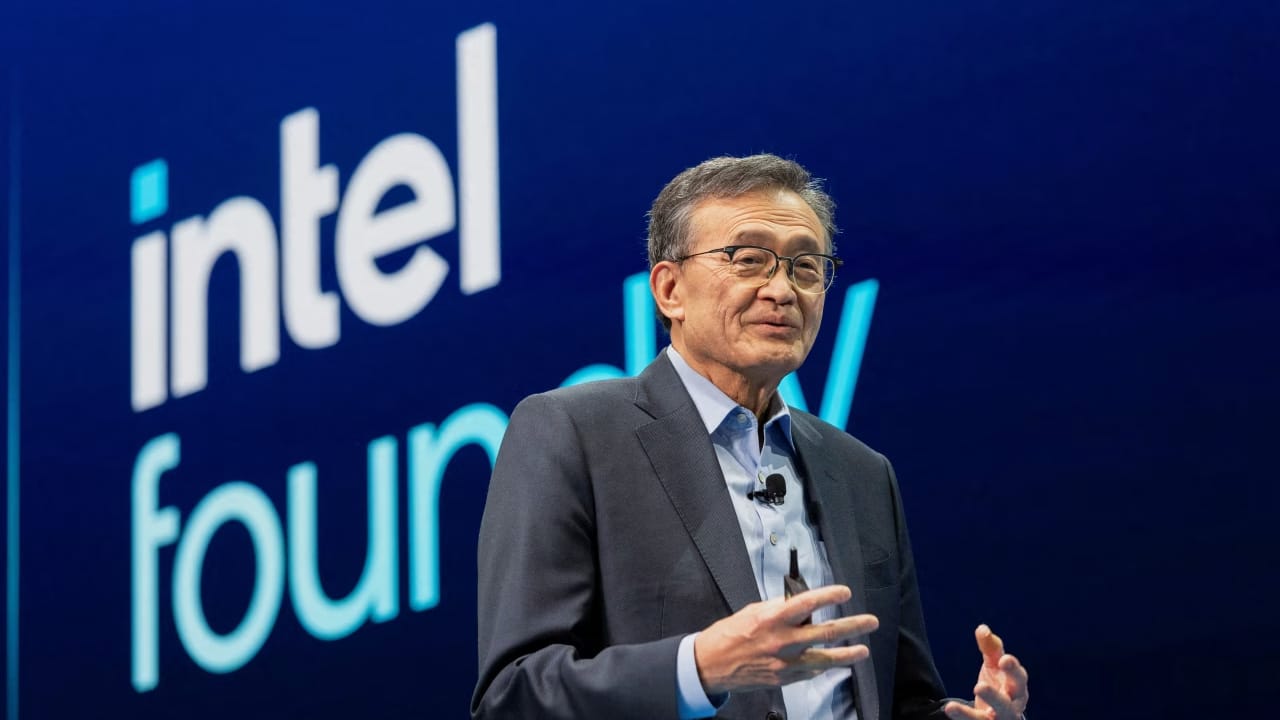

Intel’s Fragile Comeback Just Met Its Political Kill Switch

👀 What’s the move: Lip-Bu Tan, barely five months into the Intel job, is facing open calls for his resignation from Donald Trump over “conflicts of interest.” The flashpoint: a long investment history — via Walden International and personal stakes — in Chinese chip and manufacturing firms, plus a Cadence Design settlement for selling restricted tech to a Chinese university.

💡 Why it’s not boring: This isn’t just D.C. theater — Tan’s portfolio overlaps with industries hit by Trump-era export bans. Under the latest executive orders, U.S. citizens investing in certain Chinese semiconductor and AI sectors risk penalties. That puts Intel’s chief in the crosshairs of both national security hawks and political optics. For Trump, it’s an easy rally line: the man holding America’s chip future is also bankrolling its rivals.

⛵ Key takeaway: In the new Cold War on chips, your cap table can be as lethal as your supply chain.

TOGETHER WITH APPMYSITE

Publish Without The Tech Drama

AppMySite is a no‑code app builder that turns your WordPress, WooCommerce, or any website into a native iOS/Android app—no coding, no agencies, no fuss. Customize layouts, colors, menus, push notifications, payments, in‑app chat and analytics—all via drag‑and‑drop and live preview. Build and test for free, then publish when you're ready.

FINTECH

PayPay IPO: Son’s New Lifeline in the AI Cash Crunch

👀 What’s the move: SoftBank is lining up Goldman, JPMorgan, Mizuho, and Morgan Stanley to take PayPay public in the US, aiming for a $2B+ raise as soon as Q4. It’s the first major US IPO of a SoftBank majority-owned asset since chip designer Arm’s 2023 blockbuster. Arm, which SoftBank acquired in 2016 and still majority-owns, designs the processor architectures used in over 99% of smartphones. Its IPO at $54.5B has since ballooned to a $145B market cap — a template Masayoshi Son now wants to copy.

💡 Why it’s not boring: This isn’t just about unlocking PayPay’s value; it’s about refilling SoftBank’s AI war chest without selling off other prized holdings. Arm’s IPO gave Son a financial cushion to keep funding AI bets at scale. If PayPay delivers even a fraction of that upside, it buys him more billion-dollar AI plays without a forced sale.

⛵ Key takeaway: When Son needs AI cash, he doesn’t cut assets — he floats them. Arm was the proof; PayPay is the sequel.

LABOR

TikTok Tried to Export “996” — Germany Sent It Back

👀 What’s the move: ByteDance is gutting TikTok’s Berlin trust & safety team — 150 jobs gone — replacing human moderators with AI and cheaper outsourced labor. The move mirrors its cost-cutting in the Netherlands, Malaysia, and beyond, but runs headfirst into Germany’s unionized, strike-ready labor culture.

💡 Why it’s not boring: This is a collision between China’s hyper-direct, “efficiency-first” corporate playbook and Europe’s slow, rules-heavy employment terrain. In China, AI + contractors is just headcount optimization; in Germany, it’s a labor dispute wrapped in a PR crisis, under the shadow of the EU’s strict Digital Services Act.

⛵ Key takeaway: Global expansion isn’t copy-paste — sometimes your operating model is the export, and the market sends it straight back with red ink.

STARTUP SPOT

💰 PayPay

“QR-wave that digitized Japan’s wallet.”

Cashless pioneer: mobile QR/bar‑code payment app, supported utility and peer transfers, cards and banking—all via one app with loyalty points & cross‑border integrations.

→ Founded 2018 (SoftBank + Yahoo/Japan venture); commands over 60M users in Japan (~half of smartphone holders) with millions of merchant points of sale in tow. Prepping U.S. IPO in late 2025, targeting >$2B raise at ~$3B valuation; preparing via top banks including Goldman, JPMorgan, Mizuho, Morgan Stanley.

💊 HeartFlow

“AI-based 3D scans to preempt heart attacks.”

Transforms coronary CT (CCTA) scans into 3D models with anatomy + blood flow + plaque insights via AI‑driven FFR<sub>CT</sub>, Roadmap™, and Plaque Analysis → non‑invasive precision diagnostics for coronary artery disease.

→ Founded 2010 out of Stanford by Charles Taylor & Christopher Zarins; technology is FDA‑cleared, supported by 600+ peer‑reviewed studies, used in 1,400+ institutions and over 400,000 patients globally. IPO via Nasdaq “HTFL” in August 2025: raised ~$317M, valued at $32M.

📺 Rumble

“Free speech video at scale.”

Alt-video platform with VOD, live, ads & subs; popular with conservative and banned creators.

→ Founded 2013 by Chris Pavlovski; 68M MAUs; $775M Tether investment Feb ’25; 48% YoY revenue growth.

BAY AREA MEMOS

- Google has revamped its Finance platform with AI-powered search, advanced charting tools, and real-time data to take on competitors.

- SoftBank has reportedly purchased Foxconn's Ohio factory to build AI servers for its Stargate project with OpenAI and Oracle.

- Nvidia and AMD have agreed to pay the US government 15% of their revenue from chip sales in China to secure export licenses.

- Bain-backed medtech firm HeartFlow saw its shares surge 47.4% in their Nasdaq debut on August 8, pushing the company’s valuation to $2.27 billion.

- Rumble is considering a nearly $1.2 billion bid for German AI firm Northern Data to gain control of its significant GPU assets.

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, boasting over 1 million readers from leading companies such as OpenAI, Google, Meta, and Microsoft. Our Newsletter Brands:

- AI: AI Secret

- Tech: Bay Area Letters

- Futuristic: Posthuman

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.