⛵ Cloud Wars Tighten

Good Morning, Early Adopters!

The next phase of the cloud wars will be fought with balance sheets as much as with code.

CLOUD

Google Gets Wiz Cleared

👀 What’s happening: Google just secured unconditional EU antitrust approval for its $32 billion acquisition of Wiz, its largest deal ever. Regulators said the deal raises no competition concerns, noting Google still trails Amazon and Microsoft in cloud infrastructure share. The acquisition strengthens Google’s position in cybersecurity and enterprise cloud.

🌍 How this hits reality: This is about enterprise trust and bundled distribution. When cloud infrastructure and security consolidate under one contract, vendor lock in increases. Expect procurement cycles to tighten around fewer platforms. Security budgets may shift toward integrated cloud suites, pressuring independent vendors and raising switching costs across enterprise stacks.

⛵ Key takeaway: Cloud is becoming a security led bundle, not a compute commodity. As infrastructure, identity, and protection converge, growth shifts to platform gravity.

TOGETHER WITH QODER

Free on Qoder — With the New MiniMax-M2.5

MiniMax-M2.5 just launched — the fastest agentic model among mainstream LLMs. Built natively for agent workflows, it runs 3x faster than Opus at a fraction of the cost.

Qoder is offering 3 days of free access to celebrate the launch. No credit card required.

If you're building AI agents or want to test something beyond Claude, this is your window.

EV

Europe Pushes 1000V EV Plan to Catch Up

👀 What’s happening: Germany and EU partners have launched the 42 month ODYSSEV project to develop electric vehicle platforms above 1000 volts. The effort spans semiconductors, inverters, batteries, motors, and full system integration. It is framed as the next step after 800V architectures to enable faster charging and lighter drivetrains.

🌍 How this hits reality: 800V systems are already commercial in China and used in high end models elsewhere. Tesla’s charging hardware supports higher voltages, and heavy duty platforms are moving toward 1000V. Europe is not unveiling a breakthrough product. It is funding coordinated R&D to avoid falling another generation behind in power electronics and battery standards.

⛵ Key takeaway: This is defensive industrial policy, not a leap forward. If Europe does not lock in high voltage standards and supply chains now, the next EV cycle will again be defined elsewhere. The race is about relevance, not invention.

TOGETHER WITH MYCLAW

Join the OpenClaw Revolution

You don't need a Mac Mini to run.

Use MyClaw.ai instead. With it you can safely run OpenClaw in the cloud without any installation. It's always on, so you can finally close your laptop without killing your agent.

You can join the OpenClaw revolution with a managed OpenClaw.

INFRA

Databricks Fortifies War Chest as Software Slides

👀 What’s happening: Databricks just raised $5 billion in equity at a $134 billion valuation, plus secured $2 billion in new debt led by JPMorgan. This closed during a global software stock selloff. Annualized revenue reached $5.4 billion, up 65 percent, with $1.4 billion from AI products. Management says it will stay private and pour capital into its AI database Lakebase and Genie assistant.

🌍 How this hits reality: Investors are repricing traditional software as AI threatens to compress application margins. Databricks sits beneath that layer as a platforms that ingest, store, and meter that traffic. As enterprises consolidate sofewears and shift budgets toward unified data platforms, spending moves from fragmented SaaS vendors to centralized data backbones. AI agents amplify this shift because every workflow increases query volume, storage demand, and governance complexity.

⛵ Key takeaway: Capital is flowing away from surface applications and into infrastructure that orchestrates enterprise data. If AI adoption continues, commercial leverage consolidates at the data layer, reshaping how software budgets are allocated across the enterprise.

DAILY TL;DR

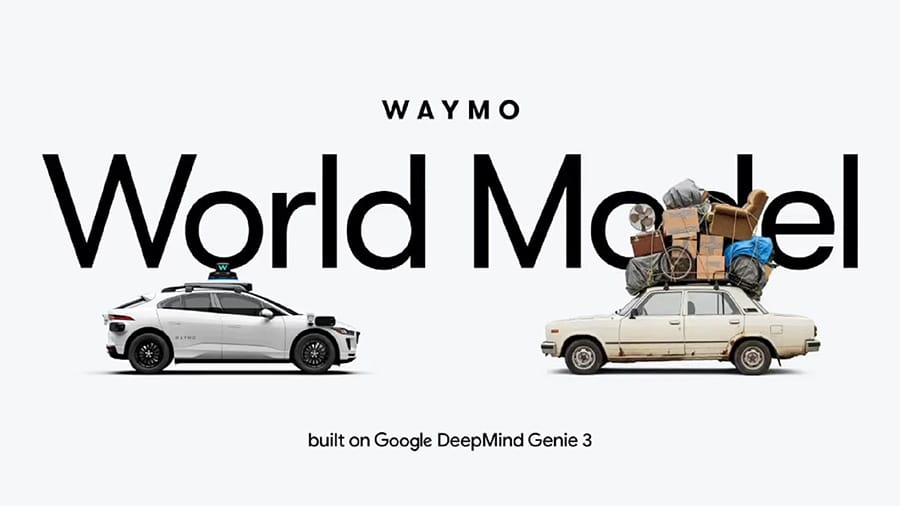

- Waymo aims to surpass 1 million paid robotaxi rides per week across the U.S. by end of 2026 as it scales commercial operations.

- LSEG plans to launch an on-chain digital securities depository to bridge traditional and tokenized markets amid activist investor pressure.

- Italy’s Italo will deploy Starlink across its fleet, becoming the first major rail operator to rely on low-Earth-orbit satellite internet.

- NASA has paused most Swift operations to slow orbital decay ahead of a planned summer 2026 reboost mission and avoid atmospheric reentry.

- Cisco raised hardware prices amid memory costs, said demand held steady, and posted record revenue.

READ MORE

Let the Future Come to Your Inbox

Stay ahead without drowning in information. We turn the most important signals across AI, tech, marketing, and future products into 5-minute reads you can actually finish.

- AI Secret uncovers what really matters in AI

- Bay Area Letters decodes tech and business shifts from Silicon Valley

- Robotics Herald tracks how robots move from labs into daily life

- Marketing Secret breaks down real growth and go-to-market playbooks

- The Hardwire explores hardware, consumer tech, and what’s coming next

- Oncely helps you discover the next wave of AI products and launches

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, reaching over 2 million leaders across the global innovation ecosystem, from OpenAI, Anthropic, Google, and Microsoft to top AI labs, VCs, and fast-growing startups.

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.