⛵ China Versus SpaceX

Good Morning, Early Adopters!

At first glance, it sounds like a heavyweight showdown: China versus SpaceX.

SPACE

China Repeats the SpaceX Challenge

👀 What’s happening: China says it plans to deploy gigawatt scale, solar powered AI data centres in orbit within five years. State contractors framed it as a response to energy limits on Earth and a direct answer to SpaceX’s own orbital compute ambitions. The announcement is folded into five year planning language, not a build schedule.

🌍 How this hits reality: Putting compute in orbit only works if launch costs collapse. SpaceX did that with Falcon 9 reuse and Starlink scale. China still has not flown a fully proven reusable rocket. Without that, orbital data centres mean $10,000 plus per kilogram, long lead times, and fragile supply chains. Power is not the bottleneck. Lift economics are.

⛵ Key takeaway: This is not the first time China has declared a SpaceX challenge. It will not be the last. Until reusability works at scale, SpaceX’s near monopoly in low Earth orbit remains intact, and orbital AI stays more strategic signal than operational threat.

TOGETHER WITH CLOUDTALK

The Future of Customer Communication

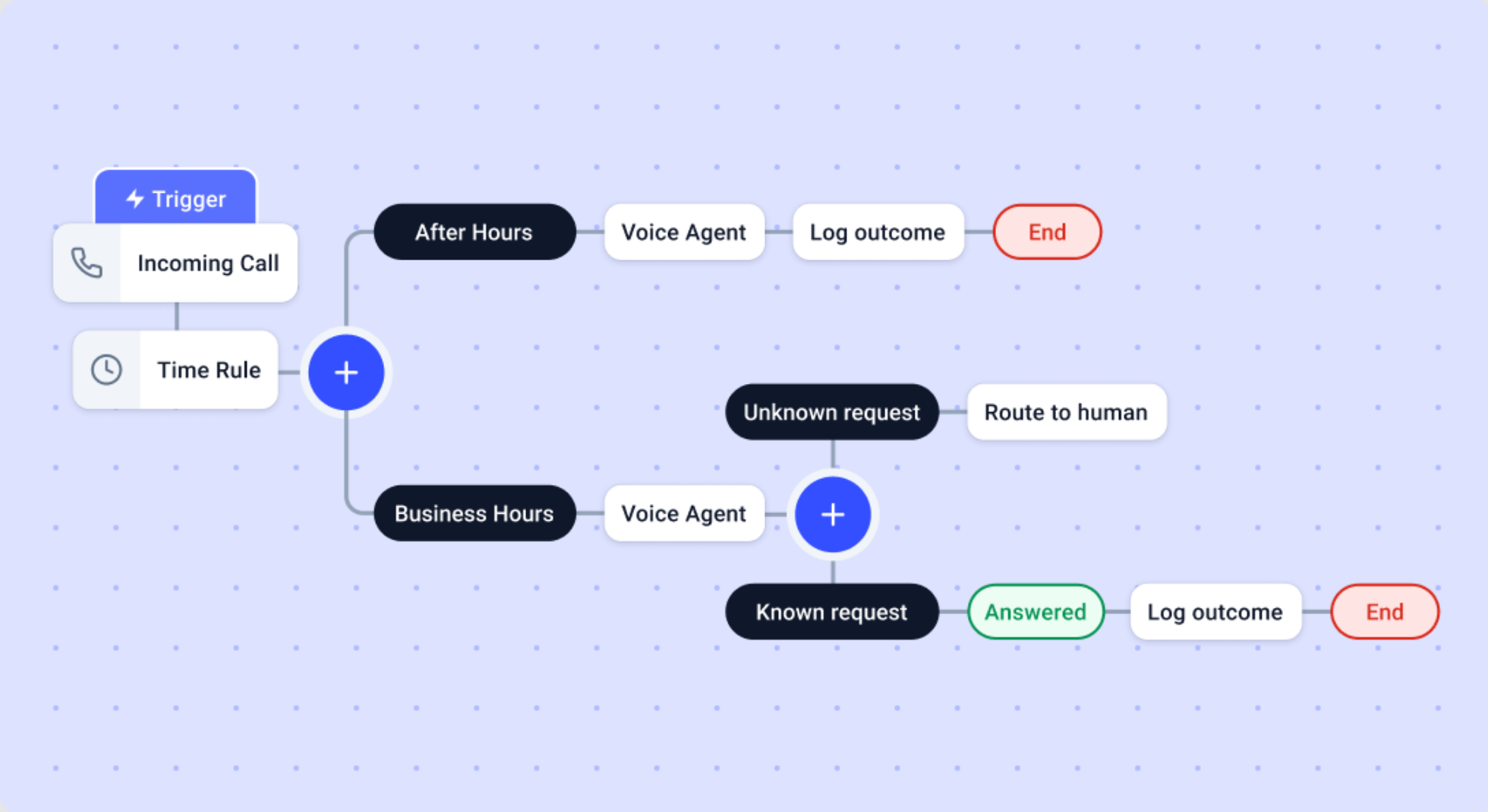

CloudTalk isn’t just another cloud call center—it’s where AI voice agents take the lead in transforming how businesses talk to customers. The AI voice agents handle repetitive inquiries, route calls intelligently, and provide instant answers—reducing wait times and boosting customer satisfaction.

For AI-driven companies, CloudTalk’s AI voice agents act as a growth multiplier:

- Automate first-line support and free up human agents.

- Personalize conversations with data-driven intelligence.

- Turn every call into structured insights for product and user research.

👉 In short: CloudTalk = global telephony + AI voice agents + seamless CRM workflows — a communication engine ready for the AI era.

RETAIL

Amazon Automated Stores Failed

👀 What’s happening: Amazon is shutting down its Go and Fresh automated stores after years of investment in cashierless technology. The systems worked technically, but the stores failed to scale profitably. 16,000 roles were cut as Amazon abandoned a highly engineered physical retail model that never fit day to day grocery realities.

🌍 How this hits reality: This failure exposes classic big company disease. Amazon designed a system optimized for internal elegance, not retail messiness. Each store required heavy upfront deployment, dense sensor grids, and rigid SKU definitions. Grocery retail depends on constant SKU churn, local demand shifts, and fast resets. The system resisted change, making every assortment tweak expensive and risky.

⛵ Key takeaway: Amazon wasn’t beaten by weak technology. It was beaten by overengineering. A bloated, high cost system that cannot flex with retail SKU dynamics turns innovation into drag. In physical commerce, adaptability beats technical perfection every time.

CRYPTO

Another Fiction of Decentralized Control

👀 What’s happening: Investors have filed a $100 million federal lawsuit accusing Cere Network insiders of fraud tied to its 2021 token sale. The claim is simple. Executives promised lockups and adoption, then allegedly dumped tokens immediately, collapsing prices over 99 percent. What looked like infrastructure behaved like an exit.

🌍 How this hits reality: Governance tokens are marketed as decentralized safeguards, yet control concentrates around founders and early insiders. When lockups are informal and enforcement is social, not technical, capital discipline disappears. Retail buyers absorb volatility while insiders retain timing advantages and information asymmetry.

⛵ Key takeaway: Decentralization remains branding, not structure. Real power sits off chain with issuers and wallets, not protocols. Expect more lawsuits, tighter scrutiny, and fewer buyers willing to confuse token mechanics with genuine distributed control.

BAY AREA MEMOS

- Gatik’s autonomous trucks have logged 10,000 fully driverless miles and secured over $600 million in contracts.

- Apple said its active device base topped 2.5 billion, with strong iPhone, iPad, and Apple Watch demand driving record quarterly revenue.

- Digital asset infrastructure firm Talos raised a $45 million Series B extension at a $1.5 billion valuation, adding backing from Robinhood and Sony.

- After years of talks, Waymo has launched limited robotaxi service at San Francisco International Airport, restricted to the rental car center.

- Apple said Patreon creators must switch to subscription billing by November 2026 to comply with App Store in-app subscription requirements.

READ MORE

Let the Future Come to Your Inbox

Stay ahead without drowning in information. We turn the most important signals across AI, tech, marketing, and future products into 5-minute reads you can actually finish.

- AI Secret uncovers what really matters in AI

- Bay Area Letters decodes tech and business shifts from Silicon Valley

- Robotics Herald tracks how robots move from labs into daily life

- Marketing Secret breaks down real growth and go-to-market playbooks

- The Hardwire explores hardware, consumer tech, and what’s coming next

- Oncely helps you discover the next wave of AI products and launches

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, reaching over 2 million leaders across the global innovation ecosystem, from OpenAI, Anthropic, Google, and Microsoft to top AI labs, VCs, and fast-growing startups.

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.