⛵ AI Darlings' New Fairy Dust

Good Morning, Early Adopters!

Every broken convention makes you a lunatic to some, a visionary to others.

GROWTH

Anthropic + Manus: RRR Is the New Fairy Dust

👀 What’s the move: Anthropic just pulled a $13B Series F at a $183B valuation, boasting $5B in “run-rate revenue.” Manus played the same trick earlier — annualizing a single hot month (current revenue × 12) and parading it as scale. Neither is quoting ARR, NRR, or churn. They’re selling acceleration, not durability.

💡 Why it’s not boring: SaaS giants live and die by ARR, NRR, and churn — metrics tied to committed dollars and retention. AI darlings now swap that for RRR — a metric that flatters growth curves and erases risk. When both Anthropic and Manus anchor valuations on extrapolation, it’s less about cash flow and more about storytelling velocity. The irony? Investors know it, and still pay up.

⛵ Key takeaway: In this market, “revenue” means whatever number gets your slope steep enough — and RRR is the new gospel.

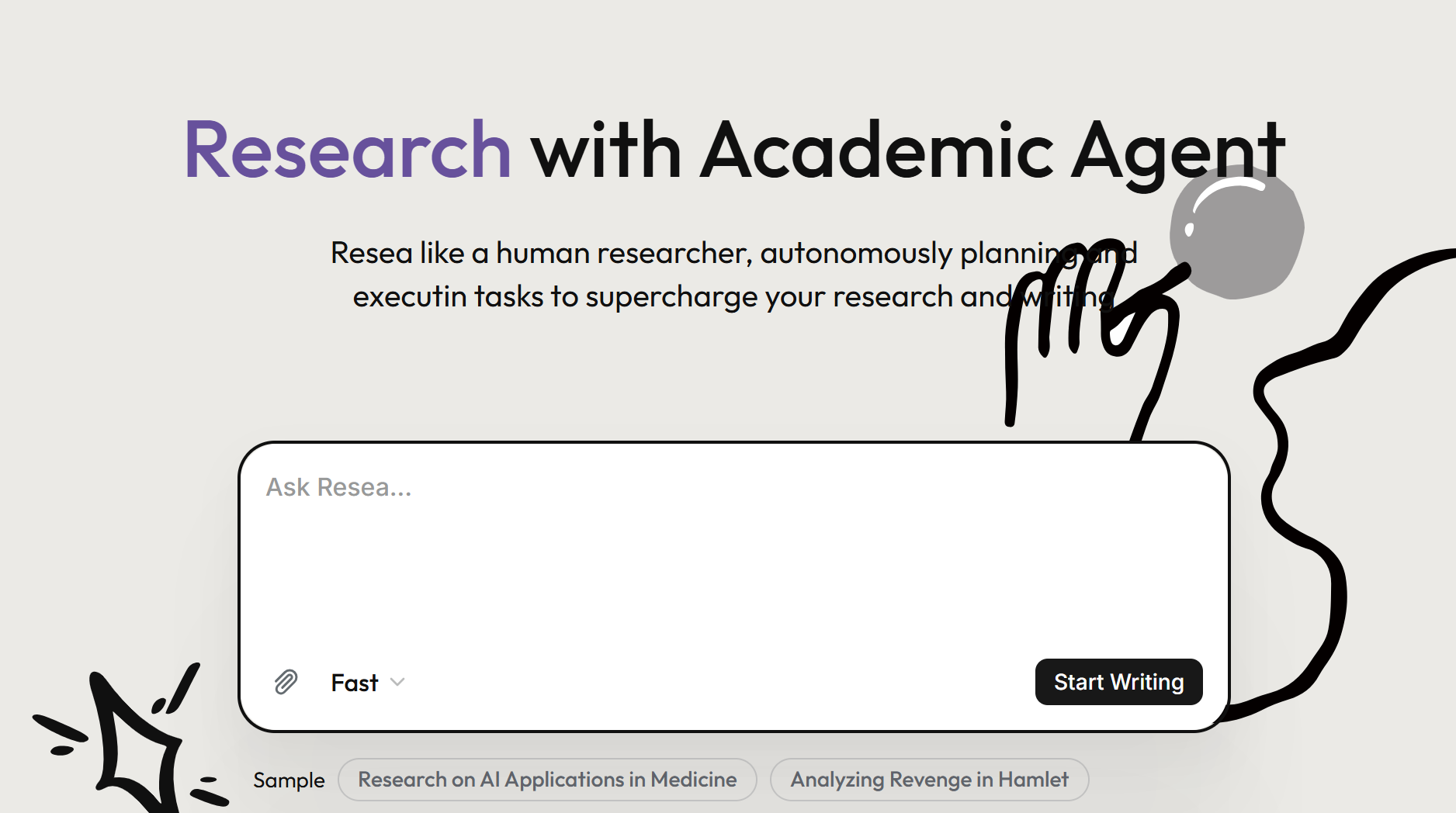

TOGETHER WITH RESEA AI

The Academic AI Agent

Meet Resea AI, the first AI agent built to think and work like a researcher. More than a writing tool, it acts as your academic copilot — planning studies, conducting literature reviews, drafting long-form reports, and formatting citations with precision.

BANK

Kapital Crowns Itself Latin America’s First AI Unicorn

👀 What’s the move: $100M fresh cash, $1.3B valuation. Kapital isn’t a shiny neobank—it’s an AI-driven back office that runs credit, cash flow, and ops for 300K SMBs across Mexico and Colombia.

💡 Why it’s not boring: This is less “fintech with AI lipstick” and more a Trojan horse. By marrying regulatory obedience with algorithmic credit rails, Kapital is building the financial nervous system for Latin America’s small businesses. Incumbent banks move at compliance speed; Kapital moves at API speed. The valuation bump isn’t about funding—it’s about declaring monopoly intent.

⛵ Key takeaway: When AI becomes the CFO for every SMB, banks stop being partners and start being utilities.

FINTECH

Galaxy Turns Shares Into Code, No Middlemen Invited

👀 What’s the move: Galaxy Digital isn’t just experimenting — it’s rewriting the equity playbook. Partnering with Superstate, an SEC-registered transfer agent, Galaxy ensures regulatory-grade compliance while letting investors tokenize actual listed shares. Superstate provides the legal wrapper and the on-chain shareholder register, while Solana provides the high-speed, low-cost public blockchain infrastructure to move and settle those shares.

💡 Why it’s not boring: The innovation isn’t “equity on a chain” — it’s Galaxy fusing Wall Street compliance with crypto-native programmability. The commercial model here is brutal efficiency: shareholders trade real stock with instant settlement, no clearinghouse tax, no middlemen friction. Galaxy isn’t just using Solana; it’s testing a blueprint that other listed companies could copy, making Solana the quiet winner in institutional adoption.

⛵ Key takeaway: Galaxy just made public equity programmable money — and Solana got the upgrade from memecoins to market plumbing.

STARTUP SPOT

🧠 Kapital

“AI-first bank for SMBs.”

Neobank with AI-powered risk, AML, credit & cashflow tools for LatAm small businesses.

→ Founded 2019 by René Saúl, Fernando Sandoval, Eder Echeverría; YC W22; full bank license via Autofin, buying Intercam assets. Sep 2025 raised $100M Series C (Tribe, Pelion) at $1.3B valuation; profitable, 300K+ SMBs served, $3B balance sheet.

🏦 ModernFi

“Deposit management for the new era.”

Tech platform automates deposit sweeping, liquidity & collateral management for U.S. banks; AI-driven risk & compliance tooling.

→ Founded 2022 by ex-Goldman Sachs engineers; Aug 2025 raised $30M Series B (Canapi, a16z, ICE); positioning as foundational infrastructure for community/regional banks.

🧠 Sierra

“AI agents for enterprise CX.”

Customer support AI agents with multi-model orchestration + supervision to cut hallucinations.

→ Founded 2023 by ex-Salesforce CEO Bret Taylor & ex-Google VP Clay Bavor. Raised $175M (Accel, Sequoia), $4.5B valuation; ARR $20M+, now targeting $10B valuation.

BAY AREA MEMOS

- French AI startup Mistral is close to raising €2B at a $14B valuation, cementing its spot among Europe’s most valuable tech unicorns.

- Scale AI is suing former employee Eugene Ling and rival Mercor for allegedly stealing trade secrets to poach multimillion-dollar clients

- The FAA approved SpaceX to boost Falcon 9 launches from Florida from 50 to 120 annually, with a new on-site booster landing zone.

- Orchard Robotics raised $22M to use tractor-mounted cameras and AI for precision crop management, aiming to evolve into a full farm operating system.

- ModernFi raised a $30M Series B to accelerate its role as core deposit infrastructure for the U.S. banking system, backed by top VCs and ICE.

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, boasting over 1 million readers from leading companies such as OpenAI, Google, Meta, and Microsoft. Our Newsletter Brands:

- AI: AI Secret

- Tech: Bay Area Letters

- Futuristic: Posthuman

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.