⛵ A New Supercycle

Good Morning, Early Adopters!

Connectivity stretches beyond infrastructure, and intelligence slips out of screens and into the environment itself.

CHIPS

AI Memory Demand Drives a Storage Supercycle in Markets

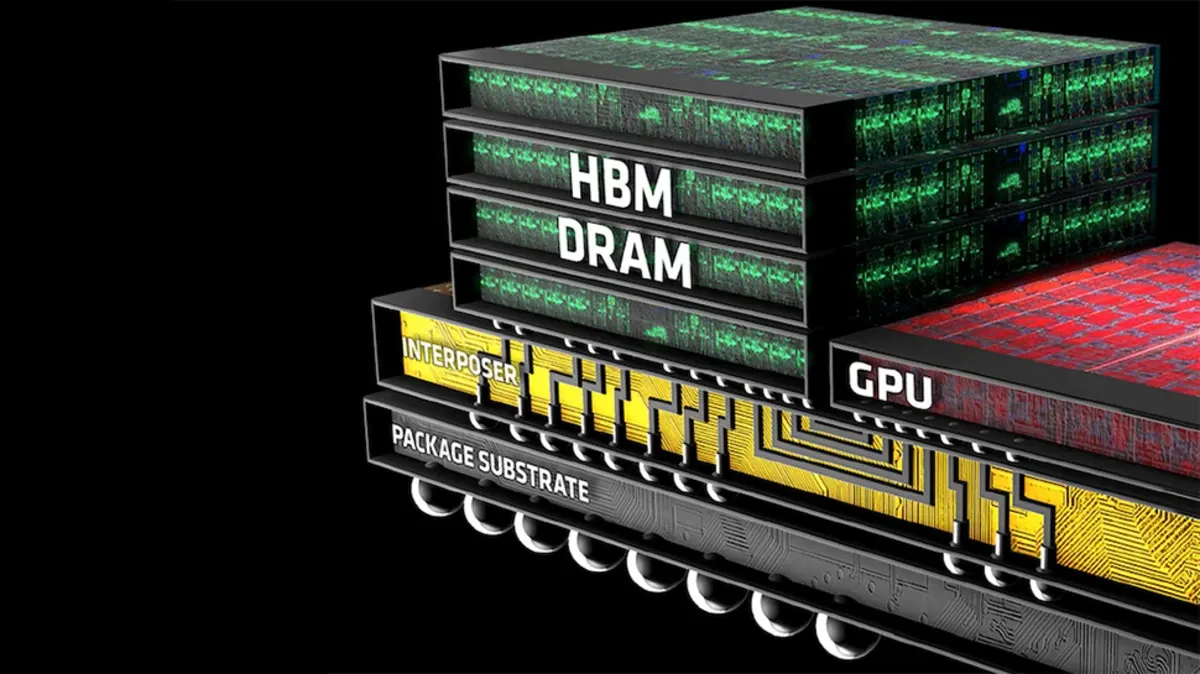

👀 What’s happening: Memory and storage stocks have exploded on surging AI demand. Micron Technology rose double digits recently after a year in which it climbed ~239% in 2025. Western Digital gained ~268% in 2025 and jumped ~14-16% on recent trading. SanDisk soared ~28% in one session and has rallied several hundred percent since its 2025 low. Samsung’s memory unit profits are forecast to nearly triple as DRAM prices climb ~313% year-over-year.

🌍 How this hits reality: AI systems are very memory-intensive. DRAM and high-bandwidth memory (HBM) are in tight supply, pushing prices up and squeezing supply chains. The scale of AI data storage demand is shifting capital into memory infrastructure and away from cycle-prone PC/phone markets. Higher memory prices are filtering into cloud costs, enterprise AI deployments, and long-term data center capex planning. Hyperscalers are OEM locking multi-year supply deals as DRAM/NAND pricing jumps across segments.

⛵ Key takeaway: If structural AI memory demand persists, storage becomes core infrastructure, not a cyclical component. Markets may see extended tight supply and elevated pricing into 2027. That means higher baseline costs for compute and cloud services and a sustained premium on memory assets relative to broader tech.

TOGETHER WITH MARKETING SECRET

The Growth Playbook Top Marketers Actually Read

Marketing Secret is a weekly newsletter breaking down how today’s fastest-growing AI and tech brands actually win users, attention, and revenue.

If you want clearer thinking, sharper execution, and ideas you can apply this week, Marketing Secret is worth your inbox.

WIFI

Two Mile Wireless Video Forces a Rethink of Connectivity

👀 What’s happening: Field tests at CES 2026 showed Puwell pushing high definition video over more than two miles with no cellular network, no repeaters, and no public internet. The Showmo MileFlask Kit relies on sub 1 GHz Wi Fi HaLow, a proprietary MileCast plus stack, and adaptive bitrate control to keep links alive where cameras normally fail.

🌍 How this hits reality: This breaks an assumption baked into modern infrastructure that remote vision must ride telecom rails. Farms, mines, energy sites, and borders often stretch kilometers. Replacing SIM based cameras with private links removes monthly fees, reduces attack surface, and restores deterministic latency under 500 milliseconds, turning video back into live operational input instead of delayed evidence.

⛵ Key takeaway: This points toward a different topology for edge AI and security. When connectivity reaches miles without carriers, sensing spreads outward. Expect fewer cellular cameras, more private networks, and renewed competition around who controls the long tail of physical space.

AI

Razer Turns Headphones into an Ambient AI Interface

👀 What’s happening: At CES 2026, Razer showed Project Motoko, a concept headset positioned less as audio gear and more as a head worn AI layer. It blends voice interaction, contextual awareness, and multi assistant access into a single always available interface. The idea is simple. Your primary assistant moves from screens into listening and daily motion.

🌍 How this hits reality: Today, assistants live behind wake words, apps, and screens. Motoko collapses that stack. Audio becomes the control plane. If this model sticks, phones lose some primacy as the first interaction surface. It stresses assumptions around attention, privacy, and battery budgets. It also pressures Apple, Google, and Meta to defend assistant ownership beyond their OS walls.

⛵ Key takeaway: This points toward assistants becoming ambient infrastructure, not destinations. If head worn AI proves useful without friction, the battle shifts from models to interfaces, and whoever owns the ear regains leverage over daily intent.

BAY AREA MEMOS

- Data security startup Cyera raised $400 million at a $9 billion valuation, up from $6 billion just six months earlier.

- Nvidia is reportedly asking Chinese customers to pay in full upfront for H200 AI chips amid regulatory uncertainty and geopolitical risk.

- Musk’s xAI will invest over $20 billion in a Mississippi data center to boost compute capacity and accelerate its generative AI ambitions.

- Warner Bros investors are split over Paramount’s higher takeover bid, while the board favors Netflix’s lower but more certain offer.

- CrowdStrike is acquiring SGNL for $740 million to add just-in-time, continuous access control capabilities to its Falcon cybersecurity platform.

TOGETHER WITH US

AI Secret Media Group is the world’s #1 AI & Tech Newsletter Group, reaching over 2 million leaders across the global innovation ecosystem, from OpenAI, Anthropic, Google, and Microsoft to top AI labs, VCs, and fast-growing startups.

We operate the industry’s most influential portfolio of newsletters, each shaping a different frontier of the AI & Tech revolution:

Be Smarter in 5 Minutes

- AI: AI Secret

- Tech & Business: Bay Area Letters

- Marketing: Marketing Secret

Discover the Future Products

- AI Launchpad: Oncely

- Robotics: Robotics Herald

- Hardwares: The Hardwire

We've helped promote over 500 Tech Brands. Will yours be the next?

Email our co-founder Mark directly at [email protected] if the button fails.